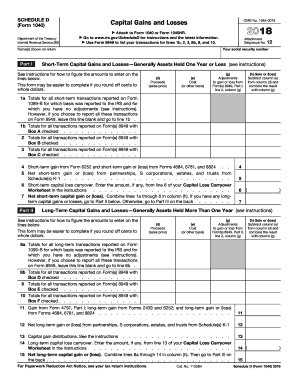

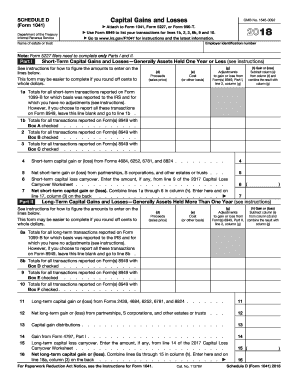

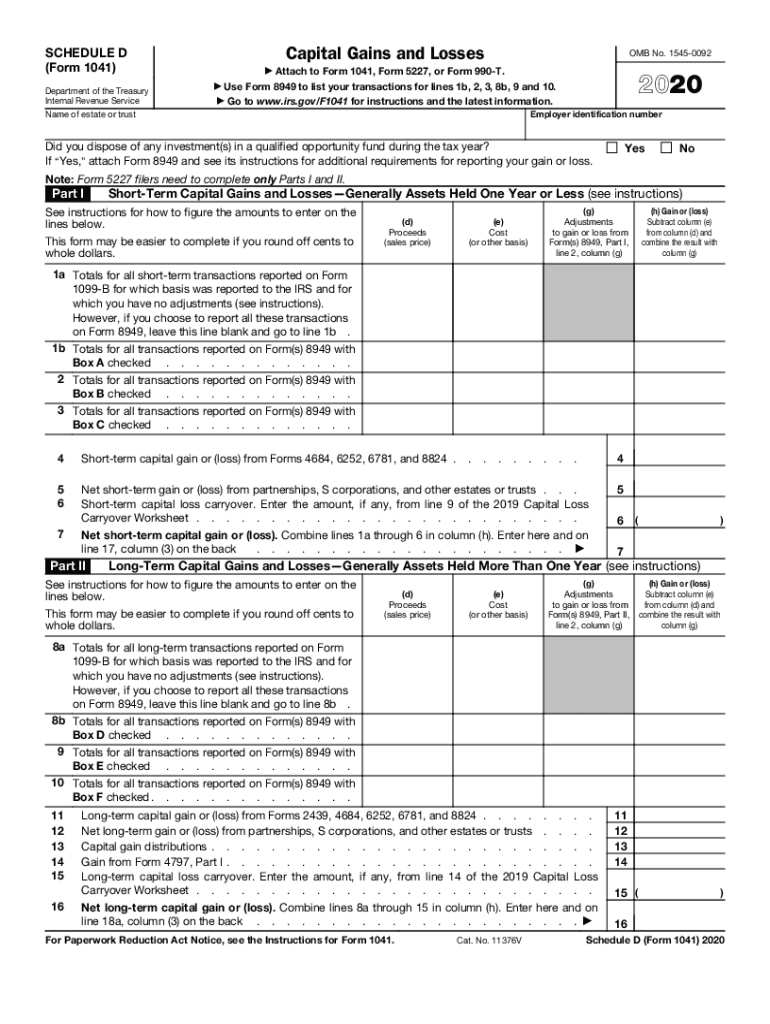

2025 Form 1041 Schedule D Printable – Ownership Duration If your business profits from selling an investment owned for less than a year, it’s taxable as ordinary income by the IRS and listed on Part 1 of the Schedule D form. If the . The Schedule D form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. Most people use the Schedule D form to report .

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)

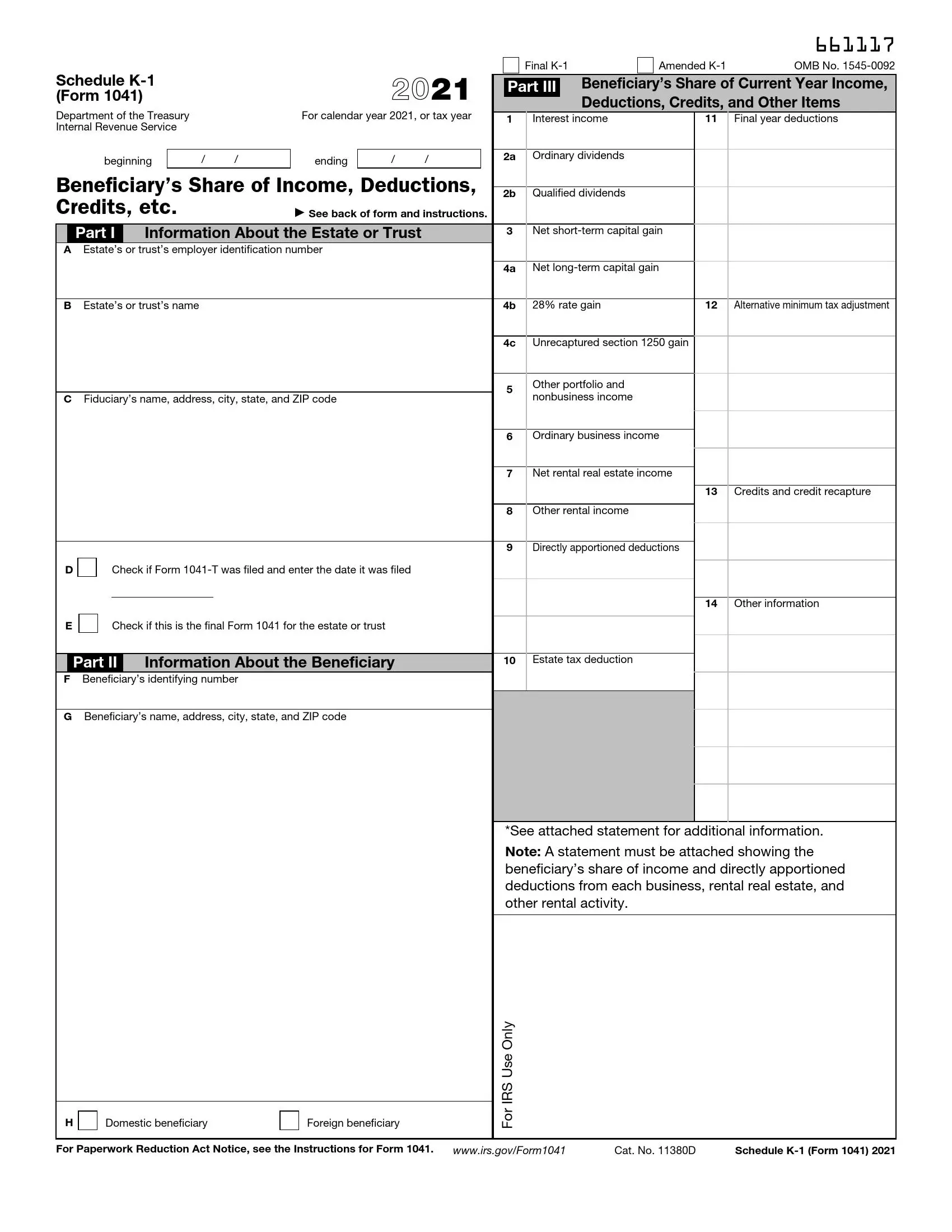

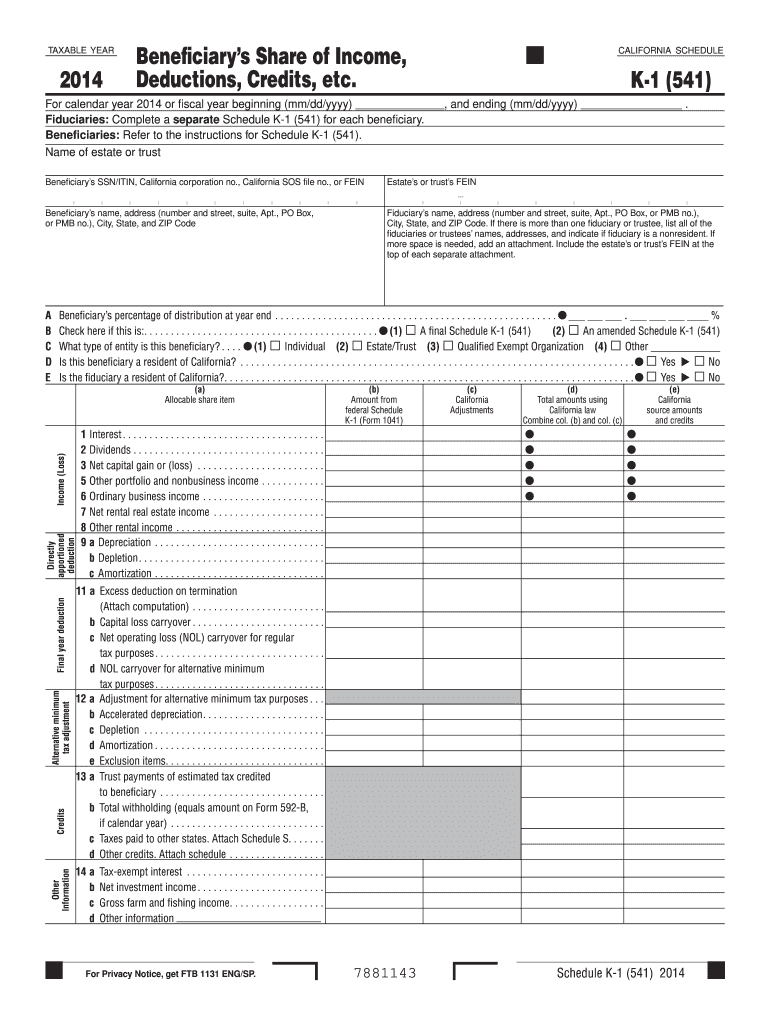

2025 Form 1041 Schedule D Printable Schedule D (Form 1041) 2025 Fill Online, Printable, Fillable : Inheriting property or other assets typically involves filing the appropriate tax forms with the IRS. Schedule K-1 (Form 1041) is used to report a beneficiary’s share of an estate or trust . Taking the deduction for property you sold can get tricky, however, because this involves either Schedule D or Form 4797, and a different set of rules applies to each. The tax rules make the most .